Insurance is protection against unexpected expenses and insurance policies are available for nearly any scenario you can envision — even your own ransom. But just because an insurance policy is available, that doesn’t mean you should buy it.

Some insurance policies give you good bang for the buck. Others are plain wasteful.

In this 3-minute segment from NBC’s The Today Show, you’ll hear of several common insurance policies and their relative merits to people of Ohio who purchase them.

For example, Americans will spend an estimated $450 million on pet insurance this year. Because of the policies’ restrictions and deductibles, though, it’s an insurance policy that rarely pays off. This is one reason why financial experts often recommend that you pass on purchasing pet insurance.

Within the segment, other reviewed insurance policies include :

- Mobile phone insurance

- Flight and travel insurance

- Extended warranties for electronics

- Umbrella policies

- Renters insurance

There’s also discussion about home warranties, and why you should avoid policies that last longer than one year.

Insurance should be an important part of your overall financial plan. However, the key is to have the proper policies in place, with an appropriate amount of coverage. Review your policies annually and keep your coverage current.

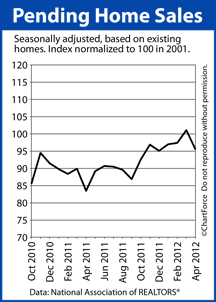

The housing market took a breather in April.

The housing market took a breather in April.