When you preview homes as a home buyer, you can get a good feel for the home’s visible traits — its finishes, its room counts, and its landscaping, for example. What you can’t get a feel for, though, is the home’s “bones”.

When you preview homes as a home buyer, you can get a good feel for the home’s visible traits — its finishes, its room counts, and its landscaping, for example. What you can’t get a feel for, though, is the home’s “bones”.

It’s for this reason that real estate professionals recommend that you have a property formally inspected immediately after going into contract for it.

A home inspection is a thorough, top-to-bottom check-up of a property’s structure and systems. It is not the same as a home appraisal, which is a valuation of the property. By contrast, home inspections are an objective report on a home’s physical condition.

Home inspections are performed by home inspectors who will typically do the following :

- Check heating and cooling systems for leaks and efficiency

- Check electrical systems for safety and soundness of design

- Check plumbing systems for venting, distribution, and drainage

In addition, a home inspector will review a home’s roofing system; its doors, windows and garages; plus, any attic spaces and basements, where appropriate.

A home inspection may also uncover out-of-code electrical work that municipalities required to be fixed by law.

Meanwhile, it’s not just home buyers who can order inspections. Sellers can order them, too.

One recommended tactic is for a home seller to have the home inspected prior to listing for sale so that all required repairs can be made in advance of showing the home. This can speed up and simplify the sales process, and may help your home sell at a higher price. Buyers often prefer homes in “move-in” ready condition.

A thorough home inspection can take up to 6 hours to complete, depending on the size of the home.

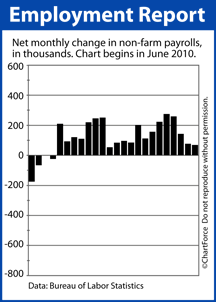

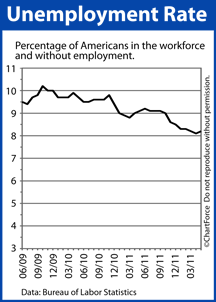

For the second straight year, the jobs market looks to be slowing into the summer.

For the second straight year, the jobs market looks to be slowing into the summer. Mortgage markets improved last week in response to ongoing concerns for the European Union and an across-the-board weakening in U.S. economic data — including the

Mortgage markets improved last week in response to ongoing concerns for the European Union and an across-the-board weakening in U.S. economic data — including the