The number of U.S. housing markets showing “measurable and sustained growth” slipped by 20 in June, according to the National Association of Homebuilders.

The number of U.S. housing markets showing “measurable and sustained growth” slipped by 20 in June, according to the National Association of Homebuilders.

The Improving Market Index is meant to identify housing markets in which economic growth is occurring as a whole — not just in the real estate space.

By using three separate, independently-collected data series, each tied to local economic conditions, the Improving Market Index takes a broader view of the housing market than other housing market indicators — the Case-Shiller Index, for example — which are often singularly tied to housing contracts.

The Improving Market Index tracks three distinct data series :

- From the Bureau of Labor Statistics : Employment statistics

- From Freddie Mac : Home price growth

- From the Census Bureau : Single-family housing growth

A given metropolitan area is categorized as “improving” by the National Association of Homebuilders if all three data series indicate growth at least six months after that area’s most recent economic trough.

In other words, the Improving Market Index looks past head-fakes of recovery, instead in search of long-term, sustainable growth.

This is one reason why its list of included cities is so fluid. It’s difficult for a metropolitan area to meet the Improving Market Index’s inclusion requirements month-after-month in a post-recession economy.

The Improving Market Index dropped to 80 in June, says the home builder trade group.

The list includes 28 new entrants, with forty-eight markets removed as compared to May. 31 states are represented nationwide.

For home buyers in Kentucky , the Improving Markets Index is a non-actionable report but it does do a good job of highlighting the local nature of real estate. For example, Columbus, Indiana was added as an Improving Market in June. Yet, Indianapolis, Indiana — located just 46 miles away — was downgraded from the same list.

Economies vary by locale.

The complete Improving Markets Index is available for download at the NAHB website. For a better gauge of what’s happening on the local level in Louisville , though, talk to a local real estate agent.

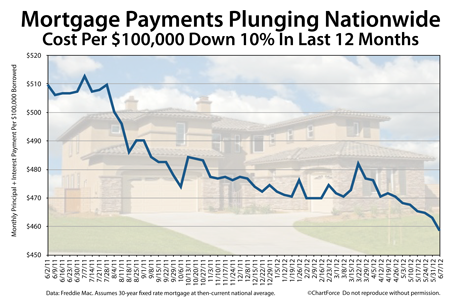

With home values slow to rise and mortgage rates at all-time lows, there’s never been a more affordable time to own a home.

With home values slow to rise and mortgage rates at all-time lows, there’s never been a more affordable time to own a home.