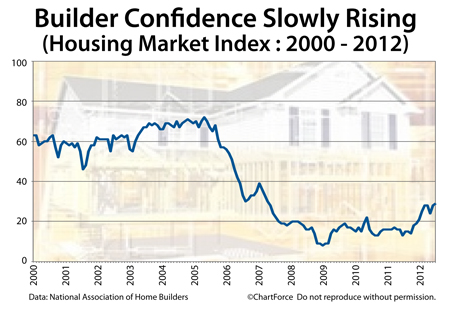

Home builders anticipate growth in the market for newly-built, single-family homes.

For June 2012, the National Association of Homebuilders reports its monthly Housing Market Index at 29 — an increase of more than 100% from one year ago and the highest HMI value since May 2007.

When the Housing Market Index reads 50 or better, it’s meant to indicate favorable conditions for builders in the single-family, new-construction market. Readings below 50 suggest unfavorable conditions for builders.

The index has not been above 50 since April 2006.

The NAHB Housing Market Index is not a “single survey” — it’s a composite. Three separate surveys are sent by the trade association to its members and roughly 400 builders respond. The NAHB’s survey questions query builders on their current single-family home sales volume; their projected single-family home sales volume for the next 6 months; and, their current levels of buyer “foot traffic”.

The results are then compiled into the NAHB Housing Market Index.

In June, home builders provided mixed replies :

- Current Single-Family Sales : 32 (+2 from May)

- Projected Single-Family Sales : 34 (Unchanged from May)

- Buyer Foot Traffic : 23 (Unchanged from May)

Of particular interest to today’s new construction buyers is that builders are reporting higher levels of single-family sales, and expect their sales volume to increase over the next six months. This expectation is rooted in housing market momentum and low mortgage rates.

Never in recorded history have homes been as affordable as they are today and home buyers are taking notice. Foot traffic through builder models remains strong and is at its highest pace in more than 5 years.

When demand for homes outweighs the supply of homes, home prices rise. If builder expectations are met, therefore, buyers in Cincinnati should expect new home prices to rise in 2012’s second half.

Planning to buy new construction this year or next? Consider moving up your time frame.

Mortgage markets improved last week, moving mortgage rates in Kentucky back on a downward trajectory. Wall Street investors bid down mortgage bond yields on weaker-than-expected economic data from the U.S. and concern for events within the Eurozone.

Mortgage markets improved last week, moving mortgage rates in Kentucky back on a downward trajectory. Wall Street investors bid down mortgage bond yields on weaker-than-expected economic data from the U.S. and concern for events within the Eurozone.