30-year fixed rate mortgage rates made new, all-time lows once again this week.

30-year fixed rate mortgage rates made new, all-time lows once again this week.

According to Freddie Mac’s weekly mortgage rate survey of more than 125 banks nationwide, the average 30-year fixed rate mortgage rate fell 4 basis point to 3.62% nationwide.

The rate is available to conforming, prime borrowers willing to pay an accompanying 0.8 discount points plus a full set of closing costs. A “prime” mortgage applicant typically has excellent credit, verifiable income, and at least 25% equity in their home.

And, it’s not just the 30-year fixed rate mortgage that made new lows in this holiday-shortened week, either. The 15-year fixed rate mortgage did, too, falling 5 basis points to 2.89%, on average.

The 15-year fixed rate mortgage requires 0.7 discount points plus closing costs.

Discount points are a one-time, up-front closing cost, based on loan size. If your loan requires 1 discount point, that means that your loan has a closing cost equal to 1 percent of your loan size. If your loan requires two discount points, the fee would be equal to two percent of your loan size; and so on.

So, based on this week’s Freddie Mac survey, a home buyer in Cincinnati opening a $200,000 mortgage and paying 0.8 discount points would face to a one-time $1,600 fee to be paid at closing.

The good news is that discount points are optional.

To avoid paying discount points, simply ask your lender for a “zero points” loan. You’ll get a higher mortgage rate than what Freddie Mac shows in its survey, but you’ll pay fewer closing costs.

Today’s low rates are terrific for both home buyers throughout Kentucky and existing homeowners looking to make a refinance. As compared last year at this time, mortgage rates are down by 98 basis points — nearly one full percentage point.

Mortgage payments are much lower today as compared to July 2011 :

- July 2011 : $512.64 principal + interest per $100,000 borrowed

- July 2012 : $455.77 principal + interest per $100,000 borrowed

Today’s rates yield an 11 percent payment discount as compared to last year.

Mortgage rates are unpredictable so there’s no guarantee that low rates will last forever, much less through the summer. If today’s rates meet your household budget, consider locking something in.

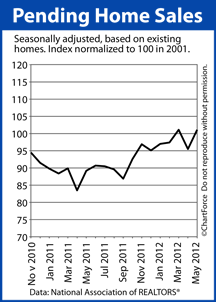

Homes are going under contract at a quickening pace.

Homes are going under contract at a quickening pace.