New construction housing is in a post-recession rally.

New construction housing is in a post-recession rally.

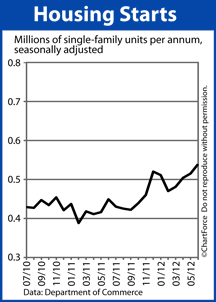

As reported by the Census Bureau, on a seasonally-adjusted, annualized basis, last month’s Single-Family Housing Starts rose 5 percent to 539,000 units nationwide. This is the highest reading since April 2010, the last month of that year’s federal home buyer tax credit.

A “housing start” is a new home on which construction has started.

June’s strong numbers also mark the fourth consecutive month during which Single-Family Housing Starts have climbed. This, too, has not occurred since April 2010.

The data is yet one more signal to Columbus home buyers that today’s new construction market has its worst days behind it.

Home builders think so, too.

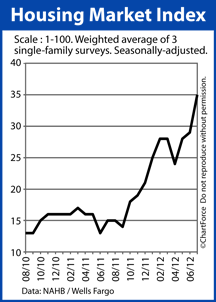

Earlier this week, the National Association of Homebuilders released its monthly Housing Market Index, a metric which tracks homebuilder confidence. Home builders report higher sales levels and massive foot traffic as compared to just 12 months ago. They also expect second-half sales in 2012 to climb sharply.

It’s no wonder that home builder confidence rose to a 5-year high. Builders are building homes and buyers are buying them.

Today’s market for new homes has been spurred forward by low mortgage rates, but rising rents have played a part, too. In many parts of the country, a comparable home is less expensive to own than to rent, which creates an incentive for renters to buy homes instead.

The availability of low downpayment mortgage programs via the FHA and other government agencies helps as well.

It’s a good time to be home buyer. Mortgage rates are at all-time records, home prices remain low nationwide, and the real estate market is believed to be entering the beginning of a sustained, multi-year recovery.

If you’re undecided about whether now is a good time to buy a new home, speak with your real estate agent. The cost of home ownership may never be as low as it is today.

Homebuilder confidence is soaring.

Homebuilder confidence is soaring.