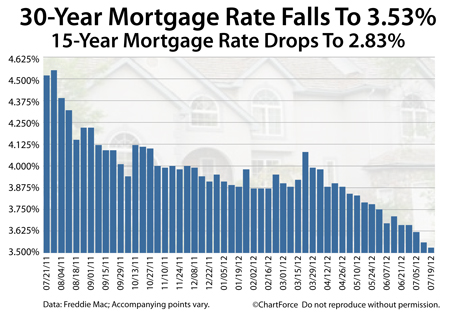

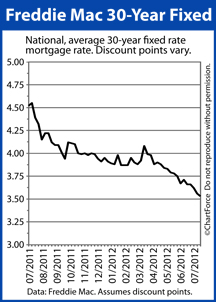

Another week, another new low for mortgage rates.

According to Freddie Mac’s weekly Primary Mortgage Market Survey, the 30-year fixed rate mortgage rate fell 3 basis points to 3.53% last week nationwide. The 3.53% mortgage rate is available to mortgage applicants who are willing to pay 0.7 discount points, on average, plus a full set of closing costs.

One year ago, the 30-year fixed rate mortgage rate was 4.52%. Today, it’s nearly one percent lower. For every $100,000 borrowed at today’s rates as compared to July 2011, a mortgage applicant will save $57 per $100,000 borrowed, or $684 per year.

Over 30 years of a loan, those savings add up.

30-year fixed rate mortgage rates have now dropped through 5 consecutive weeks, and in 11 of the last 12 weeks, a streak dating back to late-April. Depending where you live, however, you may not get access to 3.53% mortgage rates. As Freddie Mac’s survey reveals, mortgage rates vary by region.

Last week, mortgage rates by region were listed as follows :

- Northeast Region : 3.56% with 0.7 discount points

- West Region : 3.49% with 0.7 discount points

- Southeast Region : 3.58% with 0.7 discount points

- North Central Region : 3.52% with 0.7 discount points

- Southwest Region : 3.56% with 0.7 discount points

Homeowners and home buyers in California, Oregon and Washington, therefore, received the lowest rates in the country, on average. Owners and buyers in Florida and Georgia, by contrast, received the highest rates.

This week, though, mortgage rates are lower everywhere.

With Spain at risk for a sovereign default and China warning of slow growth, mortgage rates began the week by falling yet again. If you’re eligible to refinance, therefore, the timing may be right to lock a mortgage rate. Similarly, if you’re an active home buyer in Louisville , today’s low rates will bolster your maximum purchasing power.

Talk to your loan officer about capitalizing on the lowest rates of all-time. Rates throughout OH may not rise beginning next week, but when they do rise, they’ll likely rise quickly.

Mortgage markets improved last week on expectations for new Federal Reserve stimulus, plus ongoing concerns about the European Union’s future.

Mortgage markets improved last week on expectations for new Federal Reserve stimulus, plus ongoing concerns about the European Union’s future.