Home sales appear headed for a mid-summer breather.

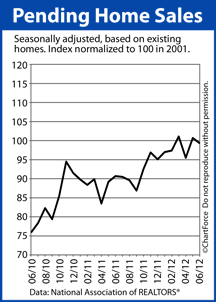

One month after posting a multi-year high, the Pending Home Sales Index retreated to 99.3 in June — a strong reading in its own right.

A “pending home sale” is a home that is under contract to sell, but not yet sold. June’s value of 99.3 marks the 14th consecutive month during which the index showed year-to-year gains.

Last year in June, the index read 90.7.

For home buyers in Cincinnati and nationwide, the 14-month winning streak is one worth noting — specifically because the Pending Home Sales Index is different from the other housing market data that tends to make headlines.

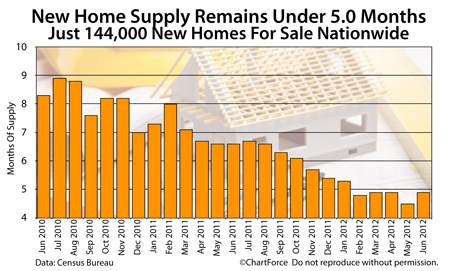

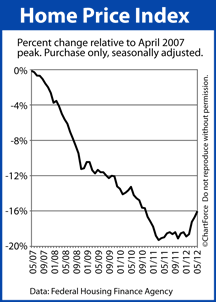

Unlike the FHFA’s Home Price Index, for example; or the monthly New Home Sales data which both report on how housing performed in the past, the National Association of REALTORS®’ Pending Home Sales Index looks at how housing will perform in the future.

With high correlation, the Pending Home Sales Index predicts how Existing Home Sales will perform two months hence. This is because 80% of homes under contract convert to “closed sales” within 60 days of going into contract, and many of the rest convert within Months 3 and 4.

In addition, June’s near-100 reading is significant.

The Pending Home Sales Index is normalized to 100, a value which corresponds to the average home contract activity in 2001, the index’s first year of existence. 2001 was an historically-strong year for the housing market which means that June’s market action was also strong.

For today’s home buyers, the Pending Home Sales Index implies that the current market is somewhat “soft” as compared to May, a scenario which lends itself to buyer-friendly negotiations. Plus, with mortgage rates at all-time lows, home affordability has never been higher.

It’s an opportune time to buy a home in Montgomery. By next month, the market may look different.

The housing market’s bottom is 9 months behind us. Home values continue to climb nationwide.

The housing market’s bottom is 9 months behind us. Home values continue to climb nationwide.