Mortgage bonds worsened last week in a news- and event-heavy week. A series of non-action from the world’s central banks — including the Federal Reserve — plus a better-than-expected jobs report pushed mortgage rates to their highest levels in more than a month.

Mortgage bonds worsened last week in a news- and event-heavy week. A series of non-action from the world’s central banks — including the Federal Reserve — plus a better-than-expected jobs report pushed mortgage rates to their highest levels in more than a month.

Conforming mortgage rates rose in Columbus and nationwide last week.

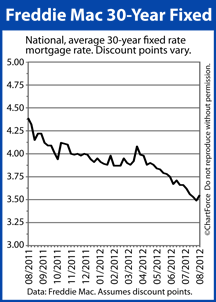

The week wasn’t without drama, however. Mortgage rates carved out a wide range.

When the week opened, mortgage markets were in a rally mode. The European Central Bank had previously said that it would do whatever was needed to preserve the European Union. However, details failed to emerge on that plan, leading to a “risk off” scenario in which investors moved money into the relative safety of bonds, a class which includes mortgage-backed securities.

Mortgage rates dropped Monday and Tuesday.

Then, Wednesday, beginning at 2:15 PM ET, mortgage rates spiked. The timing coincides with the end of the Federal Open Market Committee’s scheduled 2-day meeting and its statement to the markets. In it, the Fed said it will leave the Fed Funds Rate unchanged in its target range of 0.000-0.250%, and that it will not add new stimulus to the markets or the economy.

Wall Street had expected the Federal Reserve to launch new support for bond markets and, when the Fed chose against it, bond markets sold off, sending mortgage rates higher.

Thursday, mortgage rates, once again, slipped. This occurred after the European Central Bank emerged from a meeting with no clear plan to “save the Euro”. Markets believe the ECB will take some action, but because that action won’t happen right away, investors once more poured into the relative safety of mortgage bonds.

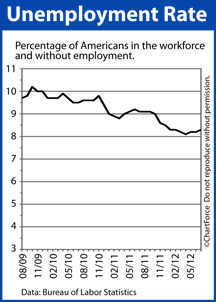

Lastly, on Friday, the U.S. Non-Farm Payrolls report showed 163,000 net new jobs added in July, far exceeding analyst expectations of 100,000 net new jobs. The surprise result sent stock markets soaring and bond markets sinking. The 30-year fixed rate mortgage rose all day, and is now at its highest level in close to 6 weeks.

Freddie Mac reported the 30-year fixed rate mortgage at 3.55% last week. It’s higher than that now.

This week, there isn’t much economic data on which for markets to move so expect to see rhetoric and momentum take center stage. Fed Chairman Ben Bernanke makes two public appearances and Eurozone leaders will continue to be in the news.

If you’re floating a mortgage rate right now, a prudent move may be to lock it.

Mortgage rates couldn’t fall forever, it seems.

Mortgage rates couldn’t fall forever, it seems. The Federal Open Market Committee voted to leave the Fed Funds Rate unchanged within its current target range of 0.000-0.250 percent Wednesday. The vote was nearly unanimous.

The Federal Open Market Committee voted to leave the Fed Funds Rate unchanged within its current target range of 0.000-0.250 percent Wednesday. The vote was nearly unanimous.