80 U.S. metropolitan markets are showing “measurable and sustained growth” this month, according to the National Association of Homebuilders’ Improving Market Index.

It’s good news for the economy and good news for housing.

The NAHB’s Improving Market Index is meant to identify U.S. markets in expansion. It’s a composite of the three distinct data sets which, as a group, present a more holistic view of a given city’s growth :

- From the Bureau of Labor Statistics, the IMI tracks employment figures

- From Freddie Mac, the IMI tracks home price data

- From the Census Bureau, the IMI tracks single-family building permits

The home builder trade group compiles this data and, in order for a given metropolitan area to earn the label “improving”, the area must meet two specific growth conditions.

First, in a given city, each of the above data sets must show growth or expansion in the current calendar month. If one of the three do not show growth, the city cannot qualify.

Second, in a given city, at least six months must have passed since the most recent trough of all of the above metrics. It’s this second clause that can make the Improving Market Index meaningful.

By focusing on long-term growth trends within a city, the IMI ignores “blips” and seasonal irregularities.

The August IMI shows 80 improving markets nationwide, a 4-city decrease from July 2012. 5 new cities were added to the index including Miami, Florida; Terre Haute, Indiana; and Lubbock, Texas. Nine cities fell off the list.

Overall, 32 states are represented in the IMI, and the District of Columbia, too.

For today’s Cincinnati home buyers, the IMI doesn’t provide much actionable information. It doesn’t show home prices, for example, nor the current demand for homes. What it shows is the strength of local economies, though, and in many cases, as the economy heats up, so do home prices.

The complete Improving Markets Index is available for download at the NAHB website.

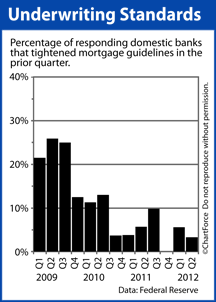

As another signal of an improving U.S. economy, the nation’s biggest banks have started to loosen mortgage lending guidelines.

As another signal of an improving U.S. economy, the nation’s biggest banks have started to loosen mortgage lending guidelines. Planning to make a late-August purchase closing? Keep an eye on your calendar. The last Friday of this month coincides with Labor Day Weekend, which may make for a complicated, end-of-month closing.

Planning to make a late-August purchase closing? Keep an eye on your calendar. The last Friday of this month coincides with Labor Day Weekend, which may make for a complicated, end-of-month closing.