Should you lease a new car, or should you buy one? Like most financial questions, the answer depends on your situation. For some people, leasing a car presents distinct economic advantages. For others, buying a car is the way to go.

There’s plenty of online material to help you choose your optimal path, but this 3-minute piece from NBC’s The Today Show serves as an excellent summary. In it, you’ll learn about the basics of leasing a car, and for whom leasing can be a great fit. You’ll also hear reasons to avoid a lease completely.

The NBC interview makes all of the following points :

- Leasing allows you to drive a car that may be “too expensive” to purchase

- Leasing puts you in a new car, with the latest safety features and gadgets, every few years

- Buying a car means that you have no mileage limits, and can sell at any time

For many people, it concludes, buying a car is preferable to leasing one, with a notable exception being those people who can claim their car or truck as a tax deduction. Be sure to check with your tax advisor if you plan to take that route.

However, for another group — homeowners and active home buyers — leasing a car can invite mortgage approval trouble. This is because a car lease payment is assumed by a mortgage underwriter to be a perpetual debt; one that never reduces or gets extinguished. When a lease is complete, it must be replaced with a new lease, and so on.

Therefore, no matter how many payments remain in a lease, mortgage applicants must use the full car lease payment for purposes of a mortgage approval.

By contrast, for people whom are owners of their automobiles, car payments must only be added to debt ratios if more than 10 car payments remain until the car’s loan is paid-in-full. For homeowners and buyers in Columbus , this can improve debt-to-income ratios and support a higher purchase price on a home.

There is no firm rule for whether it better to lease a car or to own one. The arguments for both sides are compelling and reasonable. Start with the video, then do your own research.

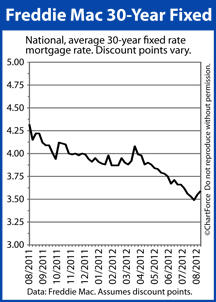

Mortgage markets worsened last week as the investors moved back into risk-taking mode. Better-than-expected economic data in the U.S. plus a general feeling that the ongoing Eurozone issues will be soon be resolved (or lessened) contributed to a second straight week of rising mortgage rates.

Mortgage markets worsened last week as the investors moved back into risk-taking mode. Better-than-expected economic data in the U.S. plus a general feeling that the ongoing Eurozone issues will be soon be resolved (or lessened) contributed to a second straight week of rising mortgage rates. Foreclosure pipelines are re-filling nationwide.

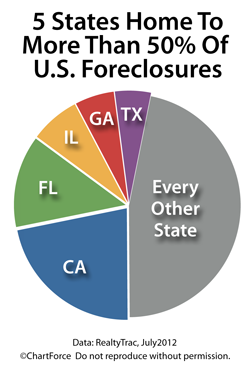

Foreclosure pipelines are re-filling nationwide.