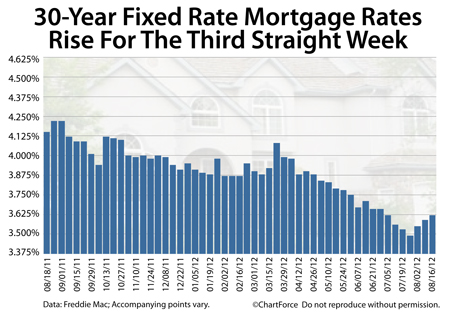

Mortgage rates in Louisville keep on rising.

According to Freddie Mac’s weekly Primary Mortgage Market Survey, for the third straight week, the 30-year fixed rate mortgage rate rose, this time tacking on 3 basis points on a week-over-week basis to 3.62%, on average, nationwide. The 3.62% mortgage rate is available to mortgage applicants willing to pay 0.6 discount points plus a full set of closing costs.

Freddie Mac’s published mortgage rates are compiled from a 125-bank survey.

Looking back, it appears that national 30-year fixed rate mortgage rates bottomed at 3.49% in late-July. In the weeks leading up to that bottom, mortgage rates had dropped in 11 of 12 weeks. Since then, though, rates have climbed steadily, moving to a 7-week high, depending on where you live.

Mortgage rates vary by region. As reported by Freddie Mac, mortgage applicants in the South Region currently pay the highest rates. Applicants in the North Central currently pay the lowest.

- Northeast Region : 3.62% with 0.6 discount points

- West Region : 3.59% with 0.6 discount points

- Southeast Region : 3.68% with 0.6 discount points

- North Central Region : 3.58% with 0.6 discount points

- Southwest Region : 3.66% with 0.6 discount points

Meanwhile, mortgage rates don’t figure to drop in the coming weeks. The same forces that drove mortgage rates down between January-July of this year are the same ones that are driving rates up today — expectations for new Federal Reserve-led stimulus.

Earlier this year, the economy was stalling; growing slowly, but not convincingly. This led to Wall Street speculation that the Federal Reserve would implement a bond-buying program that would lead mortgage rates down, among other outcomes. The Fed said it would do what is necessary to keep the economy on track which only served to fuel such speculation.

Last month, however, at the Federal Open Market Committee, Ben Bernanke & Co. did not add new stimulus, and seemed content to take a “wait-and-see” approach with the economy. And, since then, Europe appears to have put itself on-track and the U.S. economy has shown signs of expansion.

This August rise in rates is Wall Street reversing its bets; making plans for no new stimulus at all.

Mortgage rates so remain low, though. If you’ve yet to join this year’s refinance boom, or if you’re hunting for a home, consider locking something in. In a few weeks, mortgage rates may be higher still.

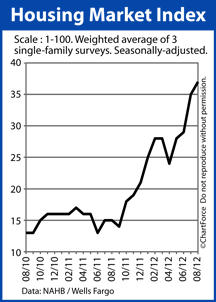

Home builder confidence rises again.

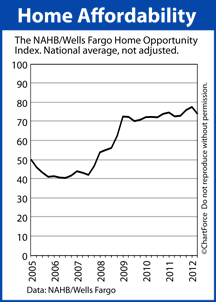

Home builder confidence rises again. Rising home prices are taking a toll on today’s home buyers. For the first time in 4 quarters — and despite falling mortgage rates — home affordability is sinking.

Rising home prices are taking a toll on today’s home buyers. For the first time in 4 quarters — and despite falling mortgage rates — home affordability is sinking.