The average family puts 10-15 percent of its monthly spending toward food, according to the Bureau of Labor Statistics and Department of Agriculture, with most of that food purchased at a supermarket.

The amount spent on food is less than the typical amount spent on housing each month but what makes food costs different from housing expenses is food costs are not “fixed”.

How much you spend on food each month is up to you and, using savvy shopping tactics plus coupons, you can lower your monthly food spend. Saving money on food leaves money for other purposes including savings, clothing and transportation.

In this 4-minute piece from NBC’s The Today Show, you’ll learn several easy-to-implement methods which can reduce your supermarket bills, as well a few “common sense” tactics you may have overlooked.

Among the topics covered in the video :

- The importance of shopping with a list, and of avoiding “the inner aisles”

- The value of generic brands, which are often near-copies of “brand name” products

- Why you should buy toiletries at a drugstore instead of at a supermarket

- Using “per unit” prices to compare different-sized packaging of the same product

- Buying fruit that’s in-season versus fruit that’s out-of-season

Another shared money-saving tip is to shop at grocery store without children. It can be fun for the family to shop together, as noted in the interview, but bringing children to the supermarket is a sure-fire way to raise your grocery bill.

Recent inflation data shows that the typical cost of food is rising in Louisville and nationwide. With these tips, perhaps you can lower your bill.

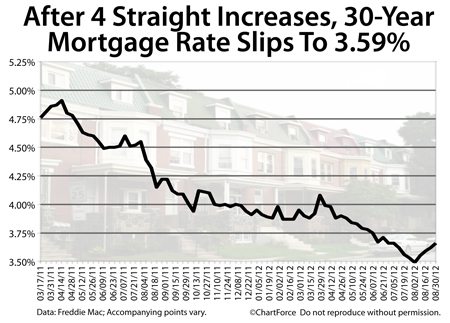

Mortgage markets improved last week for the second consecutive week.

Mortgage markets improved last week for the second consecutive week.