Mortgage rates dropped to another all-time low last week as concerns for global economic growth helped U.S. home buyers and refinancing households nationwide.

Mortgage rates dropped to another all-time low last week as concerns for global economic growth helped U.S. home buyers and refinancing households nationwide.

U.S. mortgage rates responded to non-U.S. events and, for rate shoppers and home buyers in Columbus , home affordability improved.

Early in the week, with Greece and Spain debating new austerity measures, and with citizen protests rampant, a flight-to-quality helped to boost demand for U.S. mortgage bonds. So did rumors of a weakening Chinese economy.

“Flight-to-quality” is a trading term for when investors shun investment risk in favor of safer, more high-quality portfolio assets. Typically, this involves selling stocks and buying bonds, including mortgage-backed ones.

When demand for mortgage-backed bonds rise, mortgage rates tend to fall.

Demand for bonds is also receiving a boost from the Federal Reserve’s latest market stimulus program — QE3.

“QE3” is a shorthand term for the Fed’s third qualitative easing, a program by which the nation’s central banker buys mortgage-backed securities on the open market in hopes of driving mortgage rates down.

So far, it’s been working. Since the Federal Reserve announced QE3 in mid-September, conforming mortgage rates have been on steady decline.

According to Freddie Mac, the average 30-year fixed rate mortgage rate slipped to 3.40% nationwide last week with an accompanying 0.6 discount points plus closing costs. The average 15-year fixed rate mortgage rate moved to 2.73%, also with 0.6 discount points and closing costs. Both rates are at all-time lows.

This week, mortgage rates have a lot of data on which to trade, and may be poised to bounce higher.

In addition to the release of manufacturing, construction and retail sales reports, the Bureau of Labor Statistics will post its September Non-Farm Payrolls report Friday. More commonly called the “jobs report”, the monthly release takes on added significance now that the Federal Reserve has said that its open-ended QE3 program will be linked to the U.S. jobs economy.

Wall Street expects to see 120,000 net new jobs created in September. If the actual reading exceeds this figure, mortgage rates should rise.

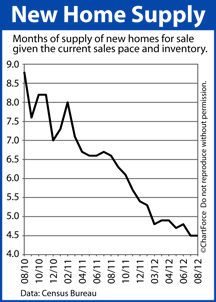

The market for new construction homes remains strong nationwide.

The market for new construction homes remains strong nationwide.