Mortgage markets worsened last week for the first time in a month as the U.S. economy showed signs of improvement, and the Eurozone stepped closer to launching its $500 billion euro rescue fund.

Mortgage markets worsened last week for the first time in a month as the U.S. economy showed signs of improvement, and the Eurozone stepped closer to launching its $500 billion euro rescue fund.

Conforming mortgage rates in Kentucky rose last week on the whole — even though Freddie Mac’s Primary Mortgage Market Survey proclaimed that they fell.

This occurred because Freddie Mac’s weekly mortgage rate survey is conducted between Monday and Tuesday each week and, last week, mortgage rates were lower when the week began. Through Wednesday, Thursday and Friday, however, they rose.

According to the Freddie Mac survey, the average 30-year fixed rate mortgage slipped to 3.36 percent nationwide last week, while the 15-year fixed rate mortgage fell to 2.69 percent. Both rates required 0.6 discount points and both marked all-time lows.

As this week begins, to gain access to the same 3.36% and 2.69% mortgage rates from last week, Cincinnati mortgage applicants should expect to pay more closing costs and/or higher discount points.

Improving U.S. employment data is partially to blame.

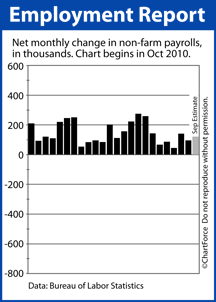

Friday morning, the Bureau of Labor Statistics released its September Non-Farm Payrolls report. More commonly called “the jobs report”, the monthly issuance details changes in U.S. employment by sector and reports on the national Unemployment Rate.

In September, accounting for upward revisions to data from July and August, 200,000 net new jobs were created — far exceeding Wall Street’s estimates for 120,000 net new jobs created. Furthermore, the Unemployment Rate unexpectedly dropped to 7.8%.

Jobs are considered a keystone in the U.S. economic recovery. As a result, when the jobs numbers hit Friday, mortgage rates worsened, building on momentum built earlier in the week as Greece moved steps closer to accepting aid from the Eurozone.

In general, since 2010, weakness in the Eurozone has helped push U.S. mortgage rates lower. As Europe regains its footing, therefore, domestic mortgage rates are expected to rise.

This week, in a holiday-shortened week, there will be little new data to move mortgage rates. The Federal Reserve’s Beige Book is released Wednesday and some key inflation data is due for Friday release. Beyond that, mortgage rates will continue to take cues from the Eurozone.

Mortgage rates remain near all-time lows.

The minutes from the Federal Reserve’s September Federal Open Market Committee meeting were released Thursday.

The minutes from the Federal Reserve’s September Federal Open Market Committee meeting were released Thursday.