Have you ever walked into your kitchen and instantly felt hungry?

Have you ever walked into your kitchen and instantly felt hungry?

Rarely do people think about the colors that they choose to paint their kitchens. They are often too busy worrying about whether the kitchen will match the rest of the home, or whether the colors will be satisfactory to the rest of the household.

However, when painting and decorating your kitchen, you may want to think about the process in a way many people do not — how the colors you choose will affect the way in which you eat. As behavioral psychologists have documented, the presence of specific colors your the kitchen can change your eating habits and your cravings for food.

Here are some examples :

- The color red increases your appetite. This is why so many restaurants paint their walls red. Although associated with romance and passion, red is also a color which promotes hunger. Furthermore, it has been noted that the color red in your kitchen can influence high blood pressure.

- The color blue is calming, which can slow your eating speed, and prevent you from over-eating. When decorating your kitchen and dining room, therefore, using blue wallpaper or blue paint; and blue placemats, for example, can result in “slower” eating and fewer feelings of fullness.

- The color orange is a “stimulating” color; increasing oxygen supply to the brain and providing a mental boost. An orange-themed kitchen may stimulate your appetite, therefore, and make over-eating more likely.

Then, there is gray. Gray can be an ideal appetite-suppressing color for your kitchen. This is because, psychologically, gray is calming and relaxing, and it neutralizes anxiety. Gray can arrest binge eating and impulsive snacking. It’s also a color which home stagers recommend for its neutrality.

Whether you’re a home buyer in Columbus , a home seller, or just getting ready to remodel, consider the influence of colors in your home. They do more than just “match the next room” — they affect your food and drink cravings as well.

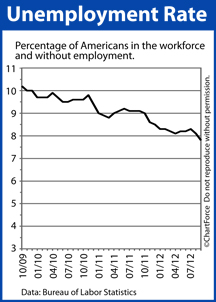

Friday morning, the government’s Bureau of Labor Statistics will release its

Friday morning, the government’s Bureau of Labor Statistics will release its