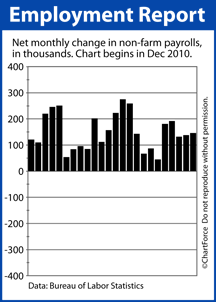

According to the Bureau of Labor Statistics (BLS) and its November 2012 Non-Farm Payrolls report, the U.S. economy added 146,000 net new jobs last month.

According to the Bureau of Labor Statistics (BLS) and its November 2012 Non-Farm Payrolls report, the U.S. economy added 146,000 net new jobs last month.

November’s job growth exceeded Wall Street expectations of 90,000 jobs added for the month, and was a small increase from October’s 138,000 jobs added.

Three job sectors in which employment rose in November include :

- Retail : 58,000 jobs added

- Business and Professional Services : 43,000 jobs added

- Healthcare : 20,000 jobs added

It appears that the effects of Hurricane Sandy were muted, although they may be temporarily overshadowed by seasonal factors.

After losing more than 7 million jobs in 2008 and 2009, the U.S. economy has since recovered more than 4.6 million jobs. Job growth has reached 26 consecutive months and is expected to remain consistent through 2013.

In addition, the BLS report showed the national unemployment rate dropping 0.2 percentage points in November to 7.7 percent. This is the lowest Unemployment Rate since January 2009.

Growing employment is a strong indicator of economic expansion, which traditionally leads to rising mortgage rates.

When mortgage people work, more income is earned and more taxes are paid. This often leads to higher levels of both consumer spending and government spending, both of which spur additional hiring and economic expansion.

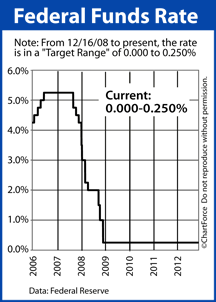

When the economy is in expansion, equity markets often gain and bond markets often lose. When bond markets are in retreat, mortgage rates in Columbus rise. This relationship takes on added importance this week with the Federal Reserve’s Federal Open Market Committee (FOMC) scheduled to adjourn.

The Non-Farm Payrolls Report is a top economic indicator and is a key part of economic and policy decision made Capitol Hill and within the Federal Reserve. As one example, recent Federal Reserve stimulus has been specifically aimed at lowering the national Unemployment Rate. As the economy improves and as jobs are regained, the Fed may be less likely to support low rates.

If you’re floating a mortgage rate, consider locking in. Rates can’t stay low forever.

The Federal Open Market Committee (FOMC) begins a 2-day meeting today, its last of

The Federal Open Market Committee (FOMC) begins a 2-day meeting today, its last of  Mortgage bonds worsened last week as Fiscal Cliff talks moved closer to resolution and as the U.S. economy showed continued signs of growth.

Mortgage bonds worsened last week as Fiscal Cliff talks moved closer to resolution and as the U.S. economy showed continued signs of growth.