Mortgage rates rose last week as investors gained confidence in the global economy. China and Europe posted better-than-expected manufacturing rates, U.S. Jobless Claims fell for the second straight week, and the worst of the European debt crisis appears to have passed.

Mortgage rates rose last week as investors gained confidence in the global economy. China and Europe posted better-than-expected manufacturing rates, U.S. Jobless Claims fell for the second straight week, and the worst of the European debt crisis appears to have passed.

Last week’s economic news provided further evidence of a strengthening U.S. economy.

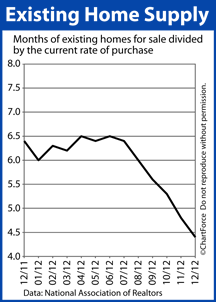

The National Association of REALTORS® released its Existing Home Sales report, which indicates that existing home sales improved by 13 percent on a year-over-year basis and are now at their highest point since 2007. The group expects sales of existing homes to increase by 9 percent in 2013.

The Commerce Department released its monthly New Home Sales report; while new home sales for December fell short of Wall Street’s expectations, sales of new homes are almost 20 percent higher than they were one year ago.

Growing demand for homes coupled with lower inventories of available homes suggests that the days of rock-bottom home prices and low mortgage rates are dwindling.

According to Freddie Mac, the average mortgage rate for a 30-year fixed rate loan was 3.42 percent with borrowers paying 0.7 percent in discount points plus closing costs. The average rate for a 15- year fixed rate mortgage was 2.71 percent with borrowers paying 0.7 percent in discount points plus closing costs.

While slight, the week-over-week increase in mortgage rates in Cincinnati could become a trend.

Weekly Jobless Claims fell below Wall Street forecasts for the second week in a row. 330,000 new jobless claims were filed; far fewer new claims were filed than the 360,000 new jobless claims expected by investors. New jobless claims also fell below the prior week’s 335,000 new jobless claims. Fewer jobless claims are a sign of a stabilizing economy.

Mortgage rates typically rise as investors gain confidence in the economy and financial markets.

This week’s economic news calendar is jam-packed.

Investors await the outcome of the Federal Open Market Committee’s first scheduled meeting of 2013, treasury auctions are scheduled for Tuesday, Wednesday and Thursday, and the Pending Home Sales Index will be released.

Plus, the Department of Labor’s Non-farm Payrolls Report and Unemployment Report will be released Friday morning.

As a home buyer in Cincinnati , you can get a feel for whether a home’s systems and appliances are in working order. However, you can’t know for certain until after the home’s been inspected.

As a home buyer in Cincinnati , you can get a feel for whether a home’s systems and appliances are in working order. However, you can’t know for certain until after the home’s been inspected. Home sales dropped last month, but not because demand was lacking. There are fewer homes for sale than at any time in the last 11 years.

Home sales dropped last month, but not because demand was lacking. There are fewer homes for sale than at any time in the last 11 years.