Last week’s economic news was dominated by events in Cyprus and the Federal Open Market Committee (FOMC) meeting on Wednesday.

Last week’s economic news was dominated by events in Cyprus and the Federal Open Market Committee (FOMC) meeting on Wednesday.

Mortgage rates fell last Monday as investors became concerned over news that a Cyprus bank bailout was in the works.

Federal Reserve Holding Course With Mortgage Backed Security Purchases

The FOMC met on Wednesday and in a press release after the meeting, noted that no immediate changes to the present economic easing program would be made.

The Fed officers will continue to monitor the nation’s economy, and are eventually expected to implement a gradual reduction of their monthly bond and mortgage backed security (MBS) purchases when the nation’s economy has recovered sufficiently.

The Fed currently purchases $85 billion in bonds and MBS in an effort to keep long term interest rates low.

If the Fed should reduce its purchases, mortgage rates would be likely to rise.

Investors viewed the Fed’s announcement as positive news and bond prices fell, which caused mortgage rates to rise, but mortgage rates finished the week slightly lower than last week.

Continuing Economic Turmoil In Europe May Encourage Lower US Mortgage Rates

In global news, the European Union (EU) threatened to withdraw its promise of aid to Cyprus banks if they cannot raise funds required as a condition of the bailout.

A one-time tax on bank deposits was suggested, but ultimately rejected as Cypriots nixed the idea of taxing their savings, even on a one-time basis.

Cyprus banks provide a tax shelter for foreign citizens, and the banking system in Cyprus is disproportionately large compared to its size.

Failure of this banking system could create serious repercussions for global financial markets.

The EU has set today, March 25 as a deadline for Cyprus to find the funding required for the bailout to be given.

Investors could seek safe haven in bonds if the EU withdraws its offer of a bailout to Cyprus banks, which usually creates downward pressure on mortgage rates.

If the EU offers Cyprus banks a bailout, then investors may respond positively and buy more stocks which would likely cause mortgage rates to rise.

Upcoming Economic Reports Could Affect Mortgage Rates

Other economic news scheduled for next week includes Treasury Auctions on Tuesday, Wednesday and Thursday.

The Department of Commerce issues its monthly New Home Sales report on Tuesday.

This report measures sales of new privately owned single family homes, and indicates buyer interest in new homes and also future demand for goods and services used by homeowners.

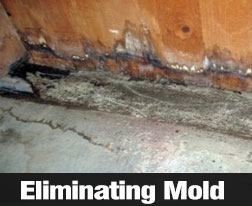

The first sign of mold you notice may be a musty smell in your home.

The first sign of mold you notice may be a musty smell in your home. The Federal Reserve’s statement after yesterday’s Federal Open Market Committee (FOMC) meeting left no doubt as to the Fed’s dual commitment to keeping long term interest rates down and encouraging economic growth.

The Federal Reserve’s statement after yesterday’s Federal Open Market Committee (FOMC) meeting left no doubt as to the Fed’s dual commitment to keeping long term interest rates down and encouraging economic growth.