Mortgage markets improved slightly last week. With a dearth of new U.S. economic data due for release, investors turned their collective attention to the Europe, China, and the Middle East.

Mortgage markets improved slightly last week. With a dearth of new U.S. economic data due for release, investors turned their collective attention to the Europe, China, and the Middle East.

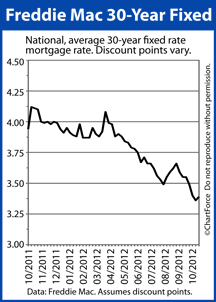

U.S. mortgage rates fell slightly in the holiday-shortened week.

The combination of civil protests, economic slowdowns, and growing political tensions caused investors to dump risky assets in favor of the relative safety provided by the U.S. mortgage bond market.

According to Freddie Mac, the average conforming 30-year fixed rate mortgage is now 3.39% nationwide for borrowers willing to pay 0.7 discount points plus a full set of closing costs. 0.7 discount points is a one-time closing cost equal to 0.7 percent of the borrowed loan size.

As an illustration, a bank’s charge of 0.7 discount points on a $100,000 mortgage would cost $700 to the borrower.

Freddie Mac also reported the average conforming 15-year fixed-rate mortgage rate at 2.70% nationwide with an accompanying 0.6 discount points plus closing costs. Loans with zero discount points carry a higher mortgage rate average.

This week, data returns to Wall Street as a series of housing reports are slated for release, in addition to inflationary reports such Tuesday’s Consumer Price Index (CPI).

The week begins with Retail Sales, released at 8:30 AM ET Monday. On a strong figure, mortgage rates in Louisville are expected to climb. This is because Retail Sales data is closely tied to consumer spending and consumer spending accounts for more than two-thirds of the U.S. economy.

A growing economy tends to pull mortgage rates higher.

Tuesday’s CPI may do the same.

Inflation erodes the value of a mortgage bond so when inflation pressures grow, demand for mortgage bonds fall which, in turn, causes mortgage rates to rise. If CPI is higher-than-expected, mortgage rates will likely rise.

Then, there’s a flurry of housing data. The Housing Market Index (Tuesday), Housing Starts (Wednesday) and Existing Home Sales (Friday) all hit this week. Strength in housing may lead mortgage rates higher, harming home affordability for today’s home buyers.

At today’s mortgage rates, every 1/8% increase raises monthly mortgage payments roughly $7 per $100,000 borrowed.