The American Consumer is alive and well, it seems.

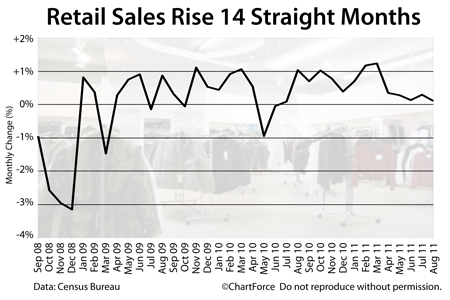

Friday morning, the Census Bureau will release its Retail Sales figures for September. The report is expected to show an increase in gross receipts for the 15th straight month with analysts predicting a 0.6 percent increase from August.

The projected increase represents the largest jump in Retail Sales in six months and would likely lead mortgage rates higher for buyers in Louisville and nationwide.

The connection between Retail Sales and mortgage rates is fairly straight-forward. Retail Sales are the majority component of “consumer spending” and consumer spending represents the majority of the U.S. economy — up to 70 percent, by some estimates.

And, as the economy goes, so go mortgage rates.

10 months ago, mortgage rates shot forward to start the year. This is because expectations were high for a strong economic rebound. Conforming and FHA rates crossed 5 percent at the time and were headed toward six.

By mid-April, though, it was clear that economic data was falling short of predictions. As a result, mortgage rates declined, kicking off the 2011 Refi Boom. Then, by August, on ongoing economic softness, mortgage rates in Ohio fell further, making new all-time lows.

Expectations for a recovery have returned. Rates are now rising.

Last week’s strong jobs report sparked hope for the U.S. economy and investors have been voting with their dollars. Mortgage rates are now up 7 consecutive days and Friday’s Retail Sales report could cement the trend.

If you’re shopping mortgage rates today, there’s risk in “floating”. You may want to lock your rate before Friday’s Retail Sales report drives rates even higher.

The Retail Sales report will be released at 8:30 AM ET.